Will mechanical hard drives end in 2028?

Pure Storage Vice President Shawn Rosemarin recently told the press that HDDS are expected to disappear by 2028 because of the continuing decline in the price of NAND per unit capacity, as well as the cost of electricity and the adoption of carbon reduction strategies everywhere. Taking this opportunity, let's talk about the current HDD market development.

At the end of last year, TrendForce data showed that 512GB SSDS (solid-state drives) and 500GB HDDS (mechanical drives) for laptops were very close in price -- and the same was true for 256GB SSDS in the middle of last year.

The main reason for this, of course, is that during the industry downturn, the memory semiconductor market has been going down, so low that this previously unthinkable thing has now happened. In fact, last year the average consumer SSD capacity was over 500GB: Go shopping for a laptop today and you'll find that the mainstream models are all 512GB - a privilege that would have been reserved for premium models a year ago. The power of the price drop is not to be underestimated: at that time, Amazon shopping site, 500GB SSD price is lower than the same capacity 2.5 "HDD.

But SSDS are not the focus of this article. Pure Storage Vice President Shawn Rosemarin recently told the press that HDDS are expected to disappear by 2028 because of the continuing decline in the price of NAND per unit capacity, as well as the cost of electricity and the adoption of carbon reduction strategies everywhere. Taking this opportunity, let's talk about the current HDD market development.

The HDD market will close to halve in 2022, while Q1 will decline 35% this year

The HDD market will close to halve in 2022, while Q1 will decline 35% this year

The top three players in the HDD market are Seagate, WDC, and Toshiba. Seagate's HDD market share was around 43% last year, according to TrendForce. In terms of device shipment figures, Seagate HDD shipments declined by as much as 43.7% year on year. Toshiba, the second largest vendor of HDDS in the market, saw its shipments decline by 39.3 percent. The shipment volume of Xieu decreased by 43.0 percent.

Seagate and Western Digital have roughly halved their sales. As a result, annual shipments for the industry are about 35 million to 36 million, a decline of about 42.5 percent. Does this number make it feel like the HDD is not far behind? But in fact, the market decline and this electronics industry inventory adjustment, as well as the macroeconomic downturn or have a considerable relationship.

Looking at different application markets, TrendForce sees declining demand for enterprise cloud storage as a big issue for HDD manufacturers today. Cloud storage related mergers and inventory corrections contributed to a market where shipments of the Q4 nearline were in the 10-11 million range last year.

In the direction of 3.5 "desktop and consumer HDD applications, shipments declined by only single digits year-on-year, but as we all know, this market basically has no hope of recovery - 3.5" HDD market previously placed hopes on security monitoring applications, and expected the consumer market will stop falling, but the reality completely failed to achieve. There is also a 2.5-inch HDD, Q4 last year saw a 15% sequential improvement, but you need to consider the Q4 shopping season.

Q1 this year was no better. Sales of HDDS fell 35% in the first quarter compared with the same period last year due to the slump in the PC and consumer electronics markets. More surprisingly, near-line HDD shipments also continued to decline.

Combined HDDS shipments from Seagate, Toshiba and Western Digital are expected to range from 33.5 million to 34.9 million in the current quarter, down 35% year on year. At the same time, the sales volume of near-line storage products in Q1 was 10.2 million, a decline of 54.3%. Even from a capacity perspective, near-line storage shipments were around 157 exabytes, a 36% year-over-year reduction.

PC and consumer electronics as well as 2.5 inch HDD actually have a relatively large decline. The shipments of HDDS in the PC and consumer electronics direction were 23.3-24.7 million, down about 24-33 percent. This is a general trend, not just a downward trend in the overall market. Last year, for example, the SSD installed rate for laptops was around 92%. TrendForce believes that SSDS will make up 96% of laptops by 2023. This part of the market for HDDS is clearly going nowhere.

Is there growth Potential for HDD?

HDD technology is now 67 years old: perhaps a relic of history for the consumer electronics market and consumers in general. But the differences in attitudes are still significant. For example, the HDD manufacturers certainly don't think that the HDD market is going to disappear in 2028.

Seagate stated in 2021 that SSDS do not "kill" HDDS. In 2021 VAST Data said that the IO limitations of HDD would eventually hinder its use in petabyte data storage. Infinidat quickly says this is a joke... Obviously, Pure Storage, which says that HDDS will be dead by 2028, is SSDS, and VAST Data technology, which says that HDD IO is a huge problem, is based on flash memory. Seagate and Infinidat obviously both work on HDDS. This argument is purely a matter of one's own position.

Speaking at the Morgan Stanley Technology, Media & Communications Conference, Seagate CFO Gianluca Romano said the long-term market performance of HDDS is not changing. The immediate problems are short-term cyclical, including inventory fluctuations.

HDD's current home ground is certainly in the enterprise, data center, and cloud: so we probably need more statistics to determine this issue. In fact, for HDDS today, product and capacity shipments are two distinct figures.

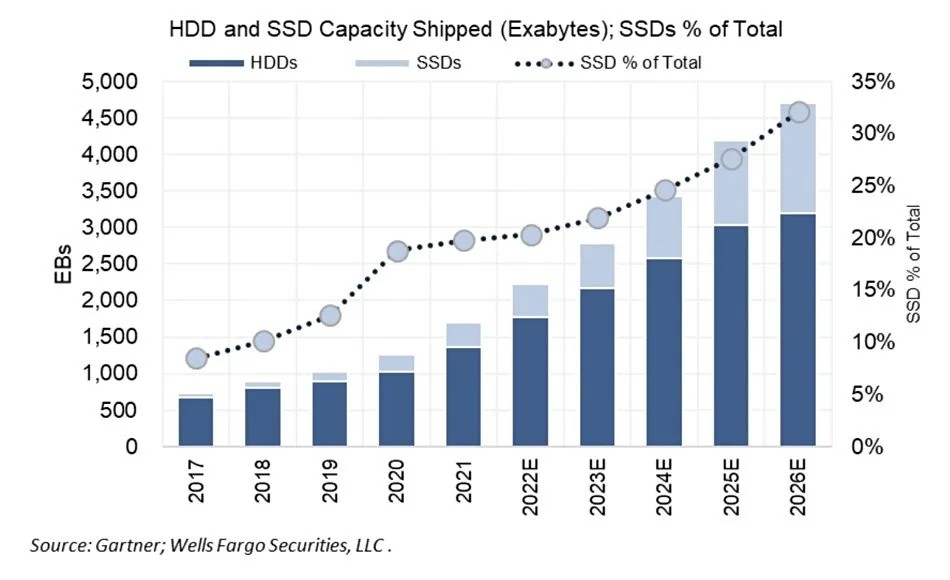

Gartner expects HDD capacity CAGR (compound annual growth rate) to be around 16% in 2022-2026; But device shipments are declining at a rate of 15 percent each year. That is because device shipments are dependent on the consumer electronics market: HDDS in products such as laptops are bound to outnumber those in business-related products such as near-line hard drives. Looking at near-line storage capacity growth alone, Gartner expects a CAGR of 22% in 2022-2026.

Near-line storage is expected to account for 96% of total HDD capacity by 2026, at which point HDD applications in other markets will become very rare. Companies such as Seagate and Toshiba will certainly exit the notebook storage market in the future, because when the market becomes small the economics will cease to exist. So-called "near-line" storage is the modern term used to describe large 7x24 hard drives that work for many years and are more reliable than desktop and laptop hard drives. Near-line hard drives can also be used for personal or small enterprise NAS systems, or more importantly for non-critical, non-performance sensitive data storage on servers.

Of course, if you add SSDS to the mix, the HDD market share is declining year by year. In 2026, SSDS will account for 32% of the combined market, with a total capacity of 1400EB. But note that HDDS still have 3200 exabytes of capacity. It is expected that the HDD market will become more competitive in the future, and all three major players will need to gain significant market share in order to maintain the possibility of HDD revenue growth.

So Seagate's prediction has some validity: There is room for continued capacity growth and revenue growth for HDDS over the long term; Even if that requires a tighter market battle.

Will HDDS die in 2028?

According to Gartner, the death of HDDS may be a long way off in 2028. Still, Pure Storage's claim has some rationale, even if it may be hard to conclude it's a dead end. Rosemarin says the root cause of the disappearance of HDDS is power consumption, which is the cost of electricity. Not the drop in SSD prices.

"Our CEO has mentioned at a number of recent events that 3 percent of global power consumption is in the data center. About a third of that is for storage. Almost all are spinning disk related. So if you could eliminate spinning platters and switch to flash memory, you could reduce power consumption by 80-90% and increase memory density by orders of magnitude. And now the price of NAND continues to fall. These are all reasons why HDDS are going away." Rosemarin said.

We think the most persuasive part of this argument is the reality of the global trend towards carbon reduction. In this general trend, some countries and regions will make power resource quota restrictions on enterprises. Rosemarin says that when a large-scale cluster company wanted to set up shop in Iceland, it was told it couldn't because it couldn't provide the electricity it needed. Assigning a certain number of employees, the size of the firm, and the lower limit of the contribution it can make to GDP in response to limited power resources seems to be the strategy of some countries and regions today.

In this case, expanding the data center is no longer just a matter of cost. Companies will even allocate project resources accordingly, or limit the amount of resources that a project can support -- so for technology and market, the use of electricity within limited resources is likely to become the future norm. The advent of generative AI, with its massive increase in data volumes, may make the topic even more complicated.

So whether HDDS will disappear at some point in the future probably really needs to be taken into account. So far, it seems that no large-scale cluster has attempted to replace the historical inventory of HDDS with SSDS, which would be a big job. It may be difficult for HDDS to disappear completely in 2028.

South Korea wants to maintain global dominance and gain a competitive edge in advanced logic chips.

In 2022, there were only five ipos raising more than $100m in the whole year. But analysts believe South Korea's IPO market will gain momentum this year, with a number of companies valued at m…Global semiconductor sales continued to decline in the first quarter, but monthly sales rebounded

"Global semiconductor sales continued to decline in the first quarter of 2023 due to cyclical markets and macroeconomic headwinds, but monthly sales rose in March for the first time in nearly a y…The United States step by step, the local key chip supply strategy how to establish?

The United States has been talking about "de-globalization" and "de-risk", in fact, it wants to kick China away in the context of globalization. Therefore, for China, the most …What are domestic chip manufacturers doing with the rapid landing of large models?

The turning point for 2022-2023 has arrivedWhat is the turning point for 2022-2023? It is the emergence of the AI big model that has turned the marginal cost of acquiring knowledge into a fixed cost. …

- Top News

- HRE CSA Series Commercial Grade MLCC Capacitor Selection Guide

- HRE CIA Series Industrial Grade MLCC Capacitor Selection Guide

- HRE CAA/CAI Series Automotive Grade MLCC Capacitor Selection Guide

- FTR20D681K Varistor Applications and Technical Advantages: Providing Comprehensive Protection for Your Circuits

- Samsung Electronics showcases its new automotive technology strategy at Foundry Forum EU 2023